Tesla Korea said Feb. 15 that it is recruiting engineers to help develop what it described as one of the world’s highest-volume artificial-intelligence chip architectures, underscoring intensifying competition for semiconductor talent as global investment in AI infrastructure accelerates.

In a job posting, the company said it is seeking candidates to work on mass-produced AI chips, adding that the project aims to develop an architecture capable of achieving the highest production volumes globally.

The hiring push comes as AI-related capital spending expands worldwide and U.S. technology companies race to secure advanced chip design capabilities tailored to their own services. Industry observers say the move reflects an effort to tap South Korea’s deep pool of semiconductor engineers to bolster AI ambitions.

Tesla currently produces in-house AI chips used in its autonomous-driving systems and humanoid robots. In July 2025, the company signed a foundry supply agreement valued at about $17 billion with Samsung Electronics to manufacture its next-generation AI chip, known as A16, at Samsung’s Taylor, Texas, facility.

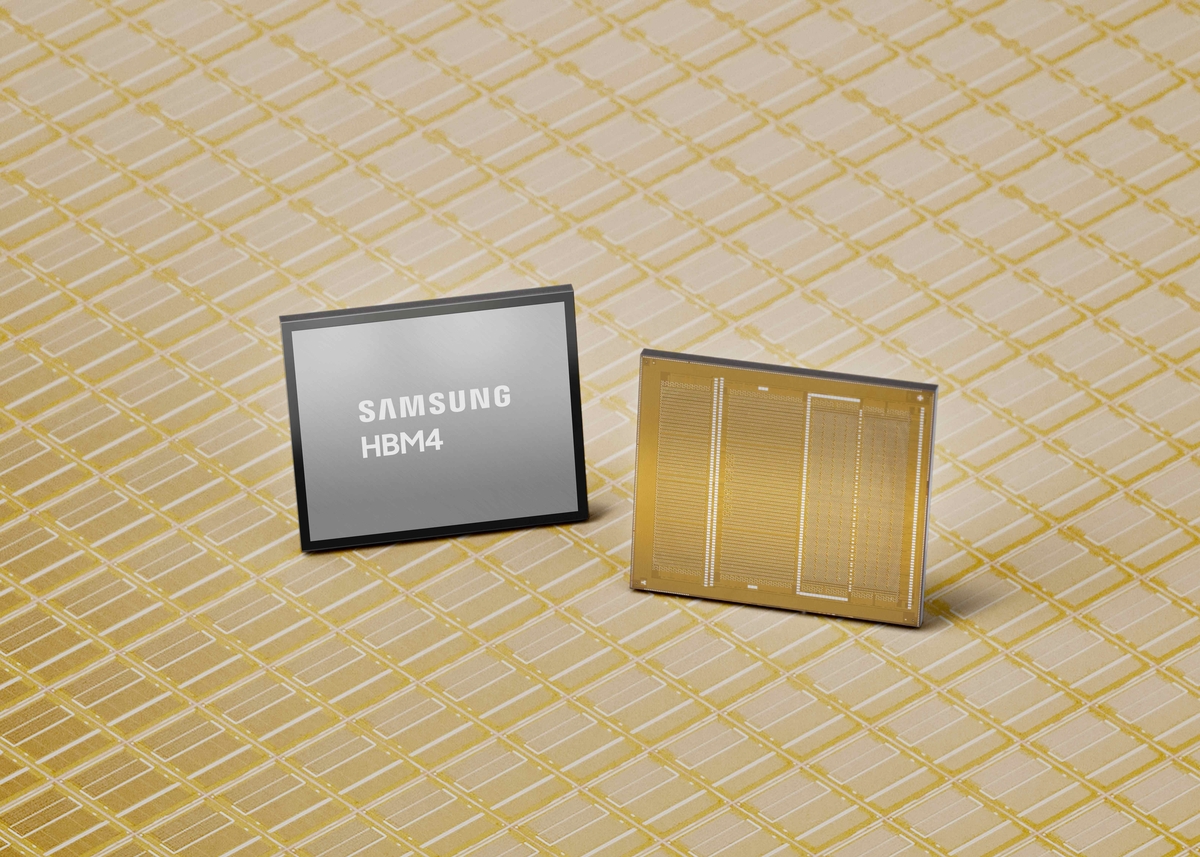

Like other U.S. tech giants, Tesla has been focusing on developing application-specific integrated circuits, or ASICs, designed to optimize performance for its proprietary services. The shift has intensified demand for engineers with expertise in advanced memory technologies such as high-bandwidth memory, or HBM, as well as chip design.

South Korea accounts for more than 70% of the global memory semiconductor market. Samsung operates not only a leading memory business but also a foundry division and a System LSI unit responsible for chip design and development, making it one of the few fully integrated semiconductor companies.

For U.S. technology firms, the country represents an attractive recruiting ground with a large concentration of highly trained chip engineers. Companies including Nvidia, Google and Broadcom are said to be hiring HBM engineers in the U.S., according to industry officials.

Competition for talent is expected to intensify as U.S. tech companies join established chipmakers such as SK Hynix, Micron Technology and TSMC in vying for engineers.

A semiconductor industry executive said that as South Korea strengthens its position in the global AI supply chain, led by HBM, recruitment efforts targeting Korean engineers by U.S. tech companies are likely to grow more aggressive. To compete, domestic firms may need differentiated retention strategies, including six-figure annual salaries and stock-based compensation, the executive added.